Nick Vance

Date: August 3rd, 2018 8:00 AM

Your credit score affects many aspects of your life. If you want a better house, apartment, job, car, cell phone, or other modern luxuries, your credit score plays a big role in whether you can get them at all.

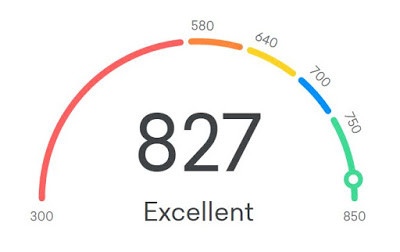

Unless your credit score is already above 750, raising it will bring you more opportunities and make it easier for you to claim the life you desire.

Follow these strategies to increase your credit score:

1. Learn what your credit score currently is, so you'll know where you're starting from.

2. Keep track of your credit score; obtain your score at least every 6 months.

3. Start paying off your credit card debt.

4. Pay off what you charge on your credit cards each month.

5. Avoid charging any of your cards up to the limit, even if you do plan to pay it off with your next payment. Spread out your purchases among several cards.

6. Pay your bills early - well before the due date - to ensure they get credited to you on time.

7. Set up automatic payments through your bank account for all your credit accounts to ensure timely payments even if you're on vacation.

8. Your debt-to-credit limit ratio should never go higher than 30% - even if you pay off what you charge each month.

9. Have errors in your credit report corrected.

10. Request an increase in your credit card limits.

11. Beware of balance transferring, especially to a card with a lower limit.

12. Send a letter to your creditors requesting that they re-age your account if you've paid at least 3 months on time and they're still listing your account as delinquent.

13. If you're having trouble making your payments, talk to your lender.

14. Avoid opening or closing several accounts at once.

15. Keep old credit accounts open. Closing them will reduce your available credit amount, raise your debt-to-limit ratio, and take away positive points for having an aged account in good standing. Keep these aged accounts active by using them every few months.

16. Maintain a mix of installment loans and credit cards.

17. Get at least one of the major credit cards: MasterCard, Visa, Discover, or American Express.

18. If you're shopping for a house, car, or other item that requires financing, try to get all inquiries to your credit to occur within a two-week period.

19. Take out a small personal loan and repay it over the year.

20. If your score is low, get a secured MasterCard or Visa and build your credit with that.

21. Pay off small disputes rather than having them sent to collections.

22. Don't give up! Raising your score takes time.